welcome to SPARK Faster, simpler

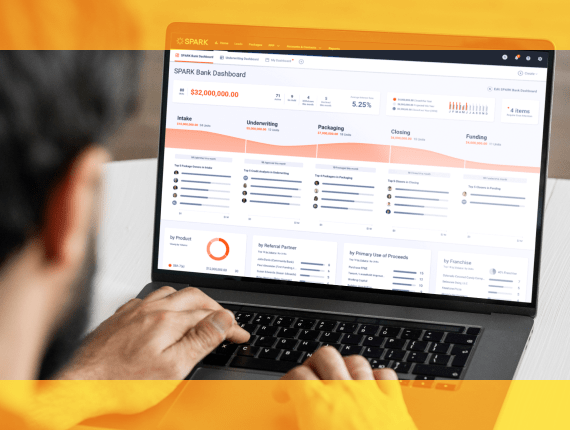

Faster, simpler

loan origination for the digital age

SPARK is the expert-designed, SaaS-based lending platform for humans, run by humans.

SPARK FOR EVERY LENDER

We’re Here to Help

We’ve been where you are, and we understand your specific lending needs. Whether you’re a bank, LSP, or mission-driven organization, we’ve designed every feature to help your organization thrive in an increasingly digital world.

For SBA Lenders

Watch your SBA program grow with tools specifically designed for small business lending.

For Banks

Experience lending without the hassle using the fastest, easiest platform to originate any loan.

For Lender Service Providers

Effortlessly manage multiple lenders at once to drive consistency and ROI.

For Mission-Driven Lenders

Focus on your mission — not workflows — to drive bigger lending impact at a reasonable price.

TIME TO VALUE

Onboard in Just 4 Weeks

Skip the hassle. Start originating loans immediately with the industry’s fastest, easiest four-week onboarding, training, and custom implementation.

Who We Help

From small community banks to multi-lender institutions, SPARK has solutions for every lender.

ABOUT US

We’re SPARK and We’re Different

We’ve been where you are. It’s what prompted us to develop a simpler lending platform built on empathy. Years later, we’re more passionate than ever about helping you connect teams and streamline lending to achieve meaningful impact.

THE SPARK LIBRARY

Insights You Can Use

Get the latest insights, articles, and news from SPARK experts about the state of lending.

Financial Inclusion: A Guide for SMB Lenders

Read this article and discover why financial inclusion matters and how lending technology can help SMB lenders support the underbanked an…

Lender Education: Why the Applicant Experience Matters

Your borrowers want a reliable, streamlined applicant experience. Learn why you shoul…

4 Industry Changes to Look for in the Coming Years

The past two years have been a whirlwind for the lending industry. 2020 gave us overw…

GET STARTED

Experience the SPARK Difference

There’s no place for manual loan origination and disjointed teams in the digital era. SPARK can get you there — faster and easier than any other platform. See for yourself.