Our Approach to Your Lending Success

Onboarding with Faster Time to Value

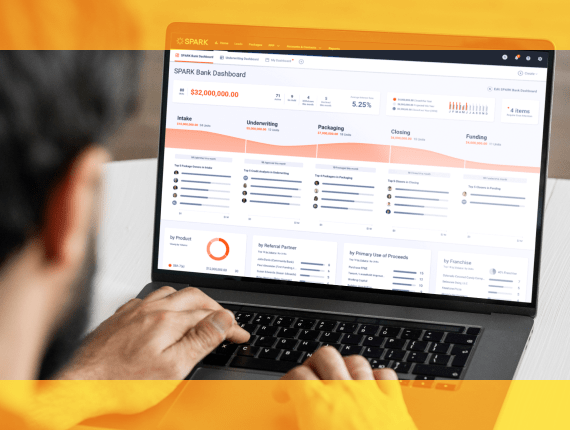

Get Acquainted with SPARK

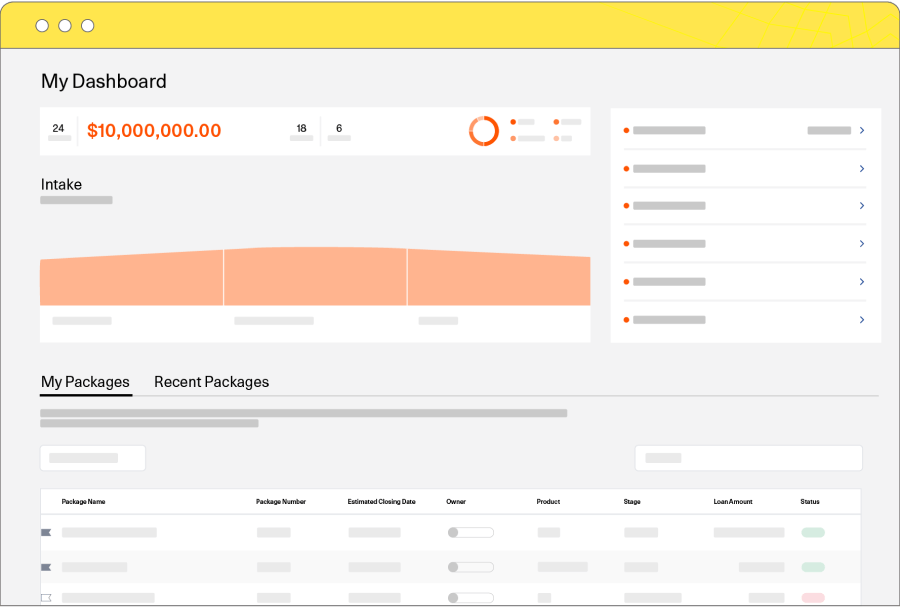

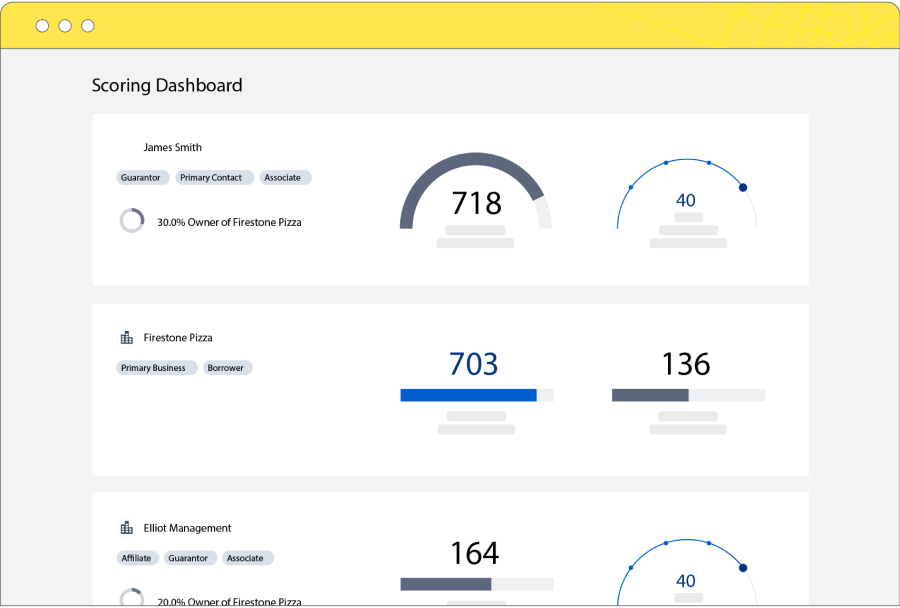

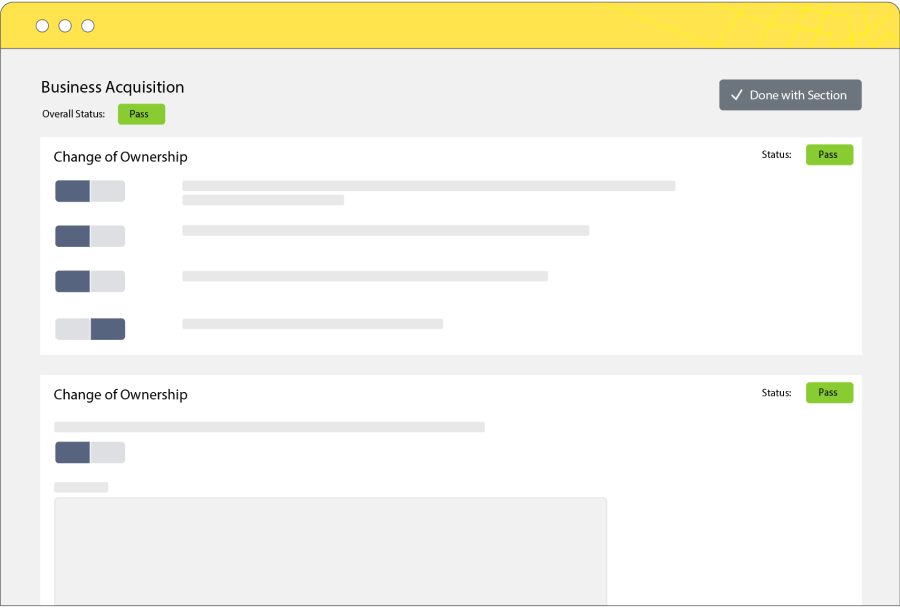

Improve Your Underwriting

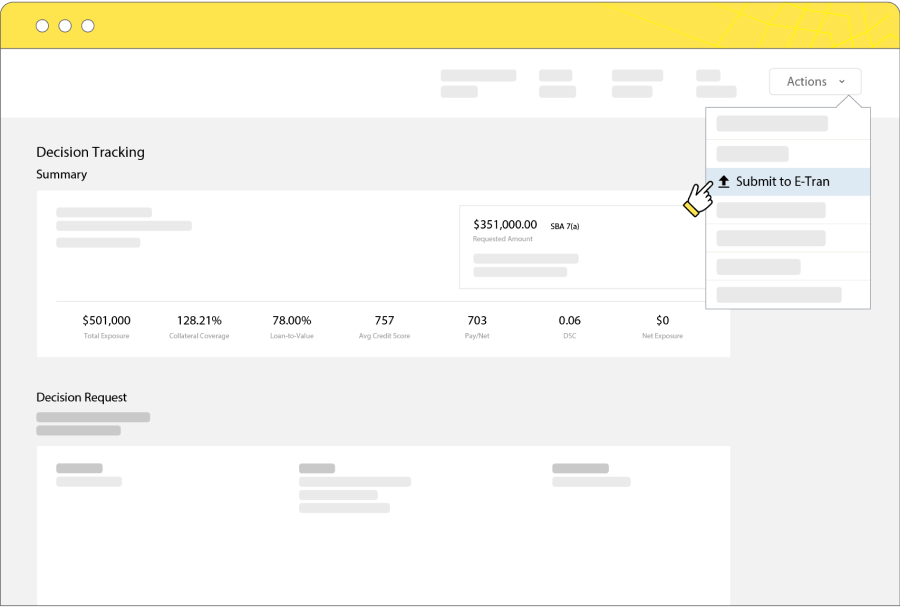

Accelerate Your Closing

Team Training and Practice

Your Success is Our Success

Customer Support

Feedback Loop

Guided In-Platform Training

Our Latest Insights

Financial Inclusion: A Guide for SMB Lenders

Read this article and discover why financial inclusion matters and how lending technology can help SMB lenders support the underbanked an…

Lender Education: Why the Applicant Experience Matters

Your borrowers want a reliable, streamlined applicant experience. Learn why you shoul…

4 Industry Changes to Look for in the Coming Years

The past two years have been a whirlwind for the lending industry. 2020 gave us overw…

Your Frequently Asked Questions

-

SPARK onboarding lasts three weeks, with an additional week for all-team training. You can expect to spend 3-5 hours per week getting to know the system and tailoring it to your team’s specific needs.

-

SPARK can meet each lender’s needs with a flexible nomenclature and navigation process.

-

We suggest appointing a “SPARK champion” at your organization to help manage your team’s involvement. This is usually a project manager or other leader. Be sure to include team leads for each of the three main stages of onboarding (sales, credit, and closing or loan operations), as well as any other subject matter experts. Each party only needs to attend the stages (about one week each) that pertain to their expertise. Any individual who will use the SPARK platform must attend the final week for live training.

-

Yes! Feel free to introduce team members to the platform early to start working through onboarding.

-

Our materials are specifically designed to help new users walk through the process step by step, ensuring an easy experience even for those borrowers who aren’t tech-savvy.

-

Each user is given a unique username and password, which they alone control. Users can also enhance security using two-factor authentication.

-

We do not connect to a servicing system, but we can generate the information needed for servicing. Using our API, we can pull data out of SPARK, which can then be used for a servicing system.

Experience Hassle-Free Onboarding

See the SPARK platform firsthand, and discover how the industry’s fastest onboarding experience gets your team ready for any loan in just four weeks.