Get Up and Running — Fast

E-Tran Integration

SBA Eligibility

Save Time with Integrations

API Functionality

Seamless Collaboration

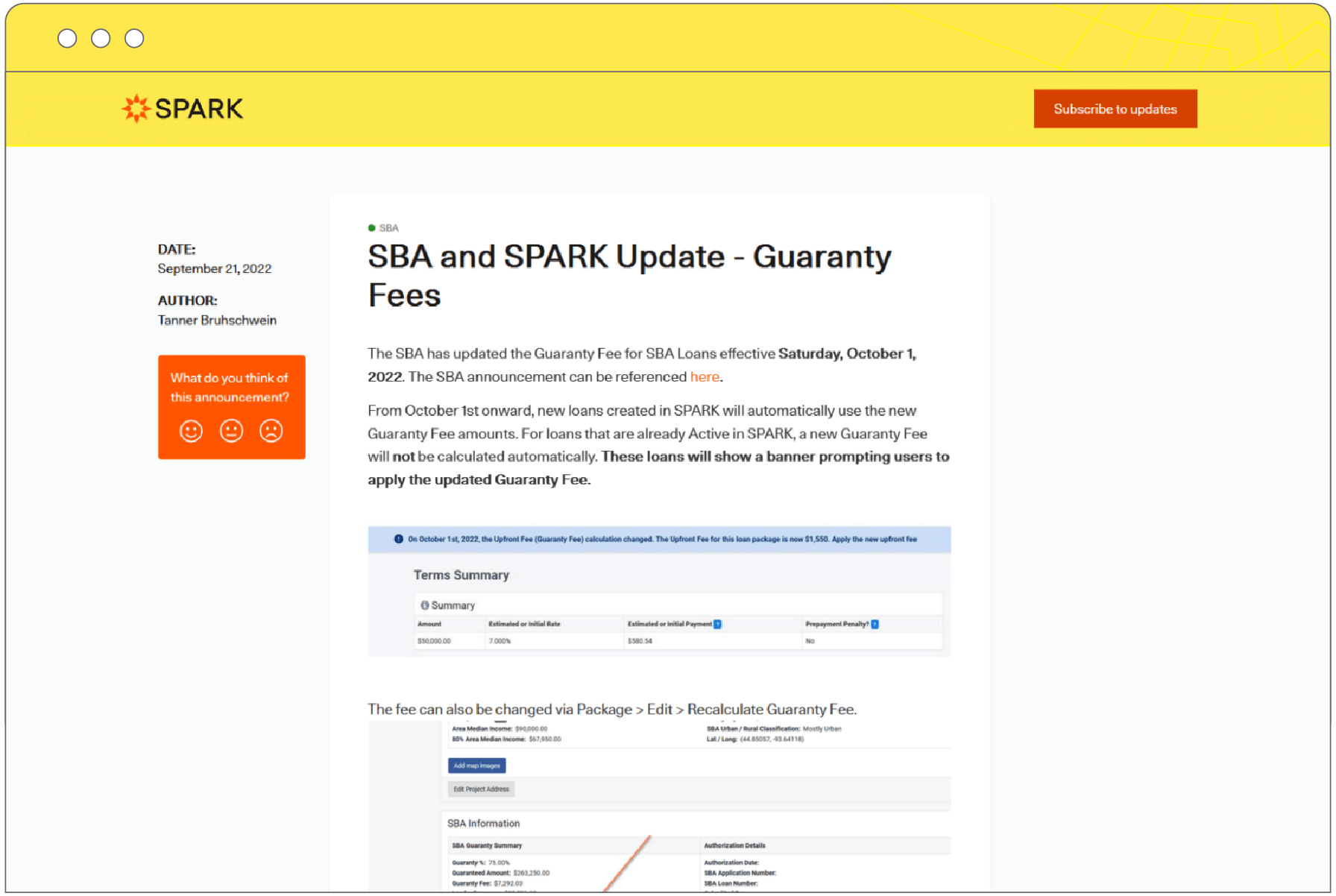

Stay on the Edge of the Industry

Cloud-Based Platform

Eight-Week Release Cycle

SBA Features You Appreciate

-

Digital Document Management

Digitize the loan process by auto-generating letters and memos through advanced organization and management capabilities. -

E-Tran Integration

Auto-generate all your SBA forms and documents, and seamlessly send through our E-Tran integration. -

Dynamic, Adaptive Checklists

Monitor eligibility in real time with checklists of the items required for a quick and accurate closing. -

Interactive Applicant Portal

Invite applicants into the digital experience with a portal to request, receive, and review necessary documents.

We’ve helped countless businesses navigate the pandemic by originating over $4 billion in PPP loans.

Our Latest Insights

Financial Inclusion: A Guide for SMB Lenders

Read this article and discover why financial inclusion matters and how lending technology can help SMB lenders support the underbanked an…

Lender Education: Why the Applicant Experience Matters

Your borrowers want a reliable, streamlined applicant experience. Learn why you shoul…

4 Industry Changes to Look for in the Coming Years

The past two years have been a whirlwind for the lending industry. 2020 gave us overw…

Your Frequently Asked Questions

-

Yes! SPARK generates all required SBA application and closing forms for you, saving time and resources.

-

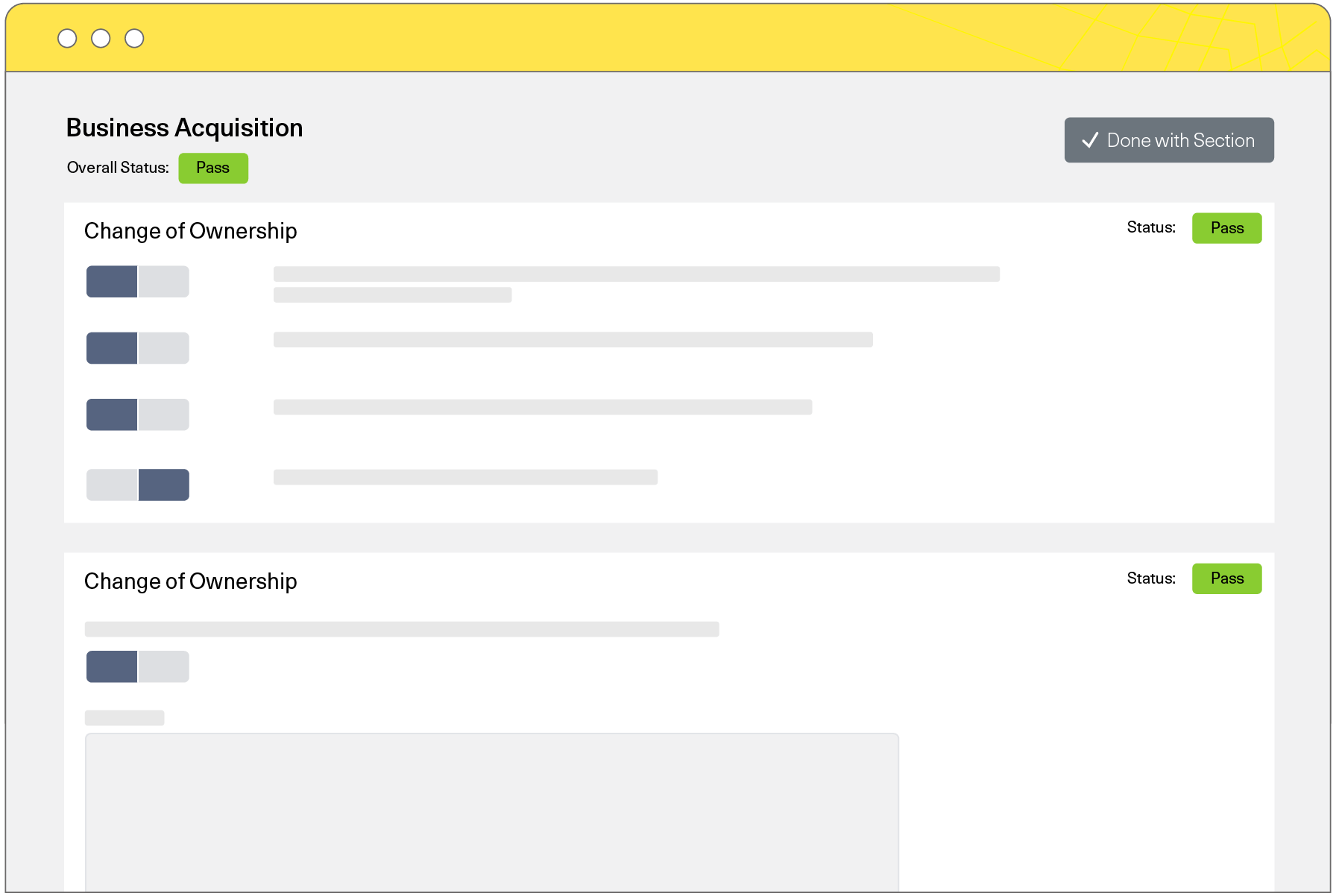

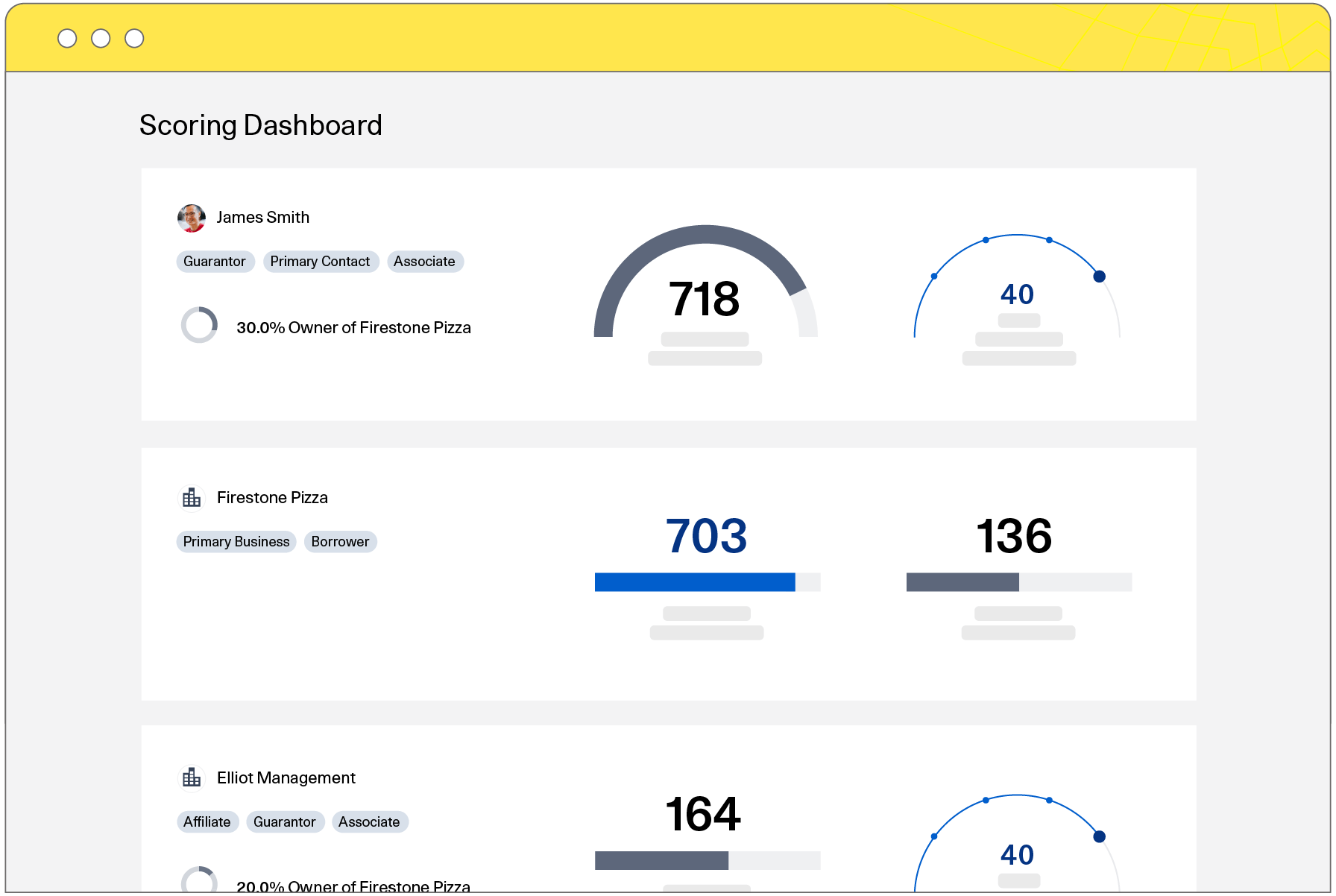

It sure does. SPARK natively supports SBA eligibility and uses a lender-configured policy section to enforce conventional lending eligibility. We calculate required information still needed based on the use of proceeds. For example, if a business acquisition is flagged in the use of proceeds, SPARK will automatically trigger the internal operations team to seek a third-party business valuation. And because it’s built into the technology, teams can focus on getting more details down without spending time on mundane tasks.

-

SPARK comes with a robust (and growing) document management system. We’ve identified and organized more than 600 documents that could be used for loan origination and provided them to each SPARK user for easy access. This includes documents you may receive via upload, documents you need to generate internally, documents required by different loan programs, etc.

-

Forget the Excel workbooks, tedious work, and constant email stream. SPARK’s equity tracking portal allows business owners to submit proof of equity via a secure portal and upload documents associated to each injection. Closers can then review and approve each individual injection, replacing a manual, error-prone process with a simple workflow for the small business owner.

-

When we say that SPARK is an “end-to-end” cloud-based lending software, we mean SPARK takes you through the entire loan origination process using one program.

- Leads: Starting with the sales process, we integrate web leads on the platform and then turn those leads into an application.

- Intake: The business development officer gathers more applicant information and sends the completed application to underwriting.

- Underwriting: Once the underwriters review the information sales compiles, they complete a financial analysis and present the loan application to an approval committee. Should the approval committee (or board) approve the loan, it seamlessly moves into the packaging stage.

- Packaging/closing: Packagers collect any and all additional documents needed to finalize the deal. For SBA deals, the loan application is sent directly to E-Tran through a SPARK integration.

- Funding: Finally, the closers and finance teams set up disbursements for the borrower.

- Funded: Once all loan proceeds are disbursed, the funded loan is available for reporting purposes.

-

SPARK has a built-in borrower portal where applicants/borrowers upload files, complete personal financial statements, and request disbursements. Each user gets a separate login to ensure the information entered is secure and confidential. Lenders are notified when borrowers enter new information and can access it at any time.

-

SPARK is different from other platforms in three ways:

- Collaboration. As an end-to-end cloud-based lending software, SPARK allows lenders, applicants, and referral partners to collaborate on one site rather than pulling in information from multiple programs and sources. This streamlined approach saves time for your organization, which may ultimately reduce loan origination times.

- Automation. SPARK uses built-in logic to automatically create a loan package based on the package characteristics. For instance, if your borrower is an LLC, SPARK knows you’ll need an Article of Organization for the loan. This logic helps simplify the loan origination process.

- Growth. SPARK offers extensive visibility, letting managers view loan packages every step of the way to proactively identify anything that might be slowing down the process. Managers can also view trends month-over-month to identify and easily address areas of inefficiency.

-

No! You do not need to have a dedicated IT staff person to support the SPARK platform. SPARK has a dedicated support line that is staffed Monday – Friday from 8 AM – 5:30 PM CST. Additionally, each client has a dedicated customer success manager who is available to address any strategy questions associated with the SPARK platform.

-

Yes! SPARK has built-in integrations with DocuSign, FICO Liquid Credit, Laser Pro, TEA, and NLS. SPARK also supports API integrations that allow SPARK to communicate with third parties.

-

Absolutely. SPARK is a SOC® 2 Type II compliant cloud-based platform that relies upon secure encryption technologies to maintain privacy of information throughout the origination process.

-

No. SPARK can address and solve most origination needs from inquiry to funding. For those problems we can’t solve directly (such as servicing), we have other options.

See SPARK for Yourself

Accelerate your SBA processes and lending opportunities with long-standing expertise built right into the solution. Take a tour of the platform, chat with an expert about your needs, and get answers to your biggest questions.