HOW WE HELP

Things Are About to Get Easier

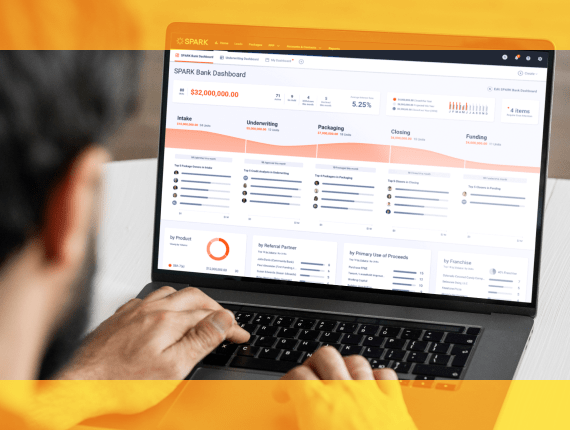

With SPARK, digital lending is simpler from day one. See how our

long-standing expertise and intuitive platform address your

needs — before you even have them.

long-standing expertise and intuitive platform address your

needs — before you even have them.

SPARK FOR EVERY LENDER

We’re Here to Help

We’ve been where you are, and we understand your specific lending needs. Whether you’re a bank, LSP, or mission-driven organization, we’ve designed every feature to help your organization thrive in an increasingly digital world.

For SBA Lenders

Grow your SBA portfolio with tools specifically designed for small business lending.

For Banks

Deliver the best, most customizable digital lending experience to your customers — and your team.

For Lender Service Providers

Effortlessly manage multiple lenders at once to drive consistency and ROI.

For Mission-Driven Lenders

Focus on your mission — not workflows — to drive bigger lending impact at a reasonable price.

OUR PROCESS

Our Approach to Your Lending Success

Complete your onboarding in just four weeks to start generating value as soon as possible. With dedicated support and an on-demand library of resources, we’re here to help (and listen to your feedback) every step of the way.

REGULAR PLATFORM UPDATES

Constantly Improving Platform

SPARK is never done improving. We release every 8 weeks to provide you with the latest and greatest features, changes you need to stay relevant, and fixes to any pesky bugs that may get in your way.

FAQS

Your Frequently Asked Questions

Get answers to your biggest questions about the benefits of SPARK.

-

Use SPARK to originate any loan, from micro-loans to large commercial loans to complex SBA and government-guaranteed loans.

-

Of course! Our open API ensures you can integrate with your favorite systems for easy data flow.

-

Yes! SPARK is accessible to third parties and even applicants, so you can easily collaborate from right within the platform.

-

Absolutely. Any third-party broker, attorney, or CPA can access SPARK for seamless collaboration.

GET STARTED

See the SPARK Difference

Discover how SPARK helps lenders like you with hassle-free loan origination, faster time to value, and regular software updates.