Get Up and Running — Fast

Remote and On-site Training

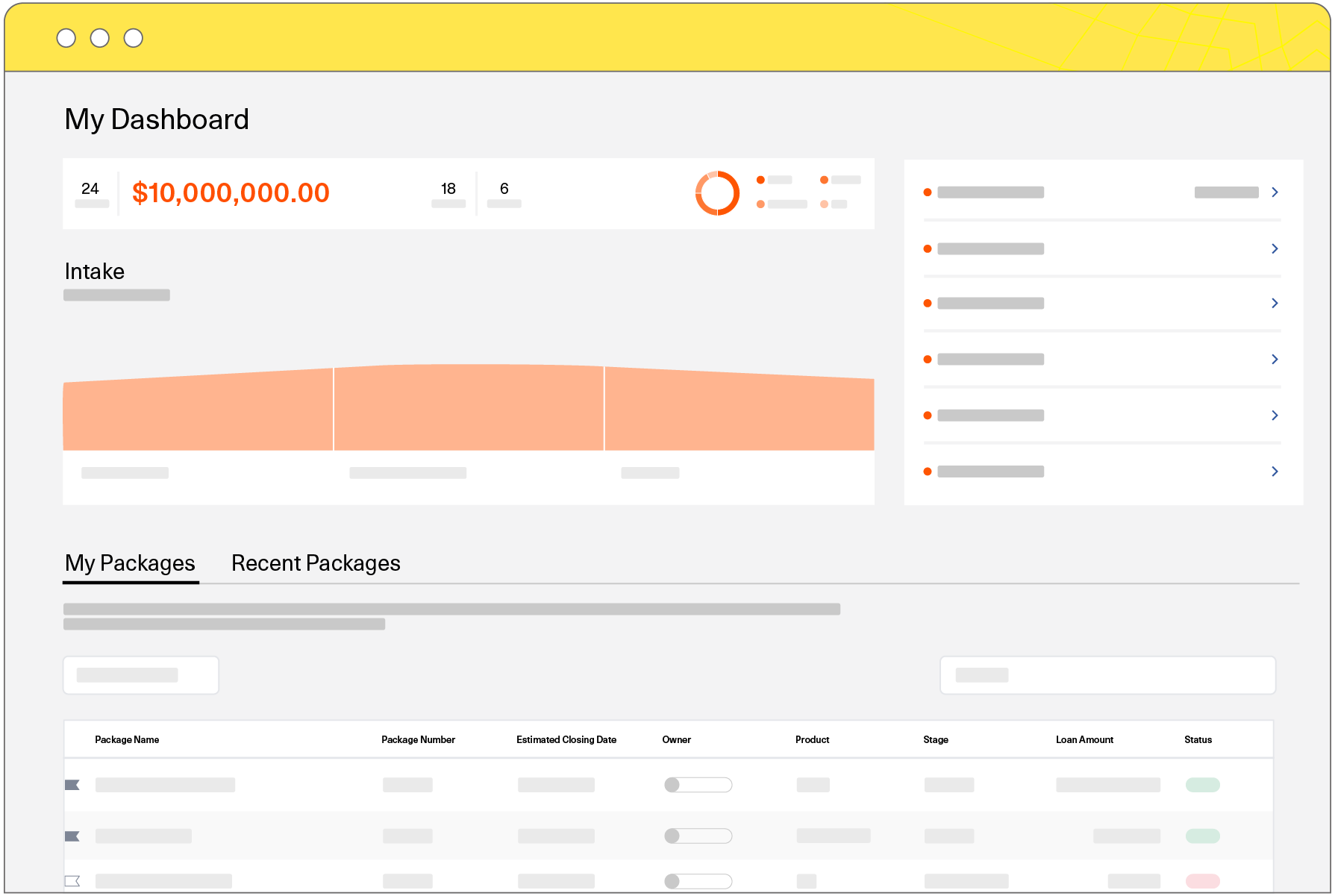

Configurable Products

Seamlessly Originate Any Loan

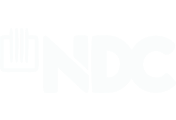

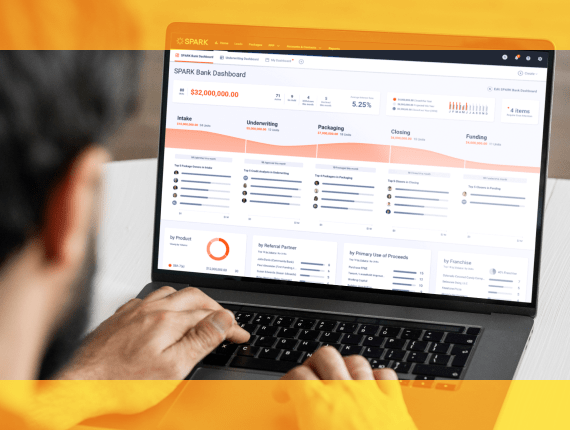

Role-Based Dashboards

Practical Integrations

Devote Time to Customers, Not Processes

Digitized Workflows

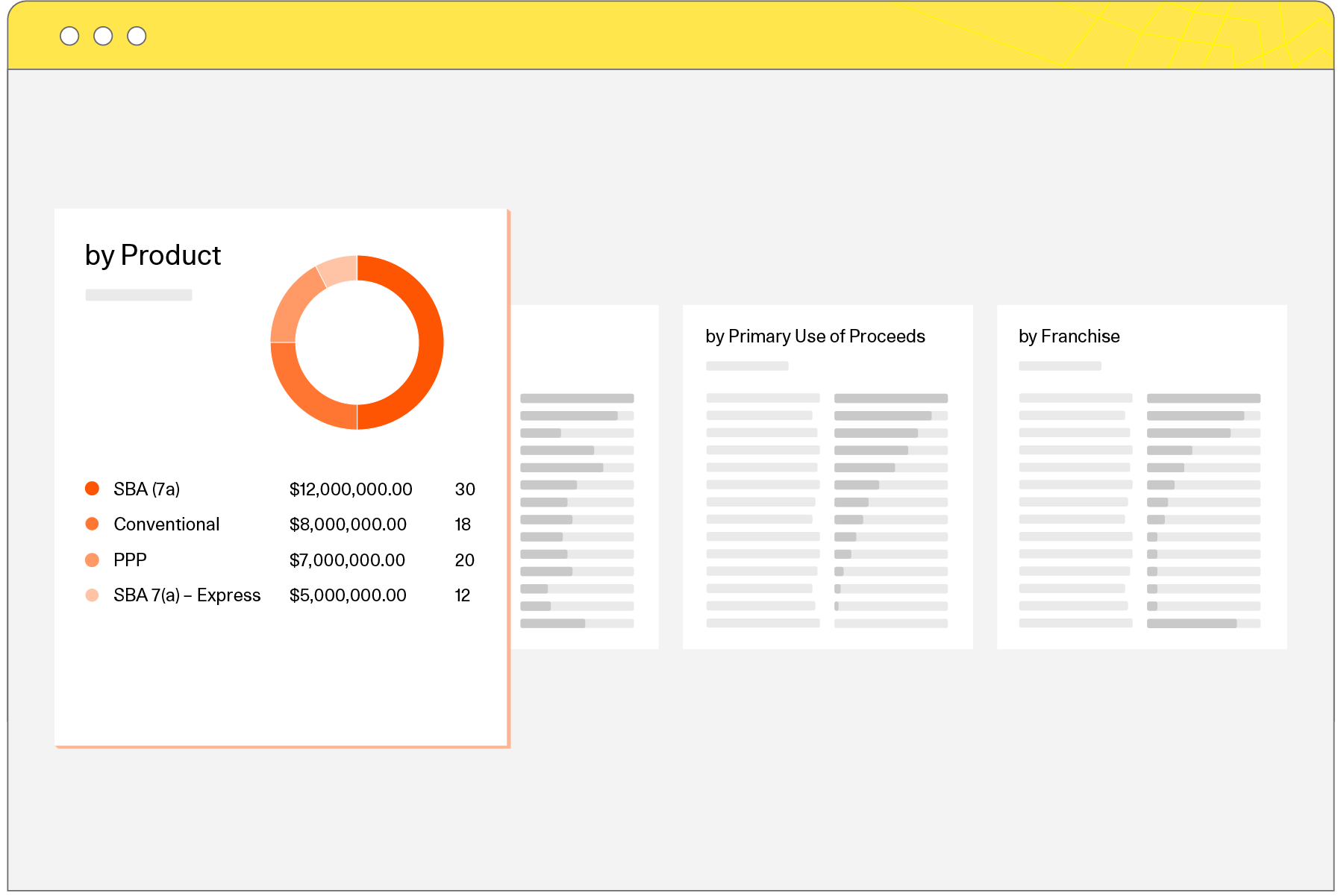

Customer View Button

What Banks Love

About SPARK

Configurability helps us meet any need.

-

Digital Document Management

Digitize the loan process by auto-generating letters and memos

through advanced organization and management capabilities. -

Dynamic, Adaptive Checklists

Monitor eligibility in real time with checklists of the items required for a

quick and accurate closing. -

Consistent Underwriting

Speed up loan decisioning with consistent credit memo templates,

document views, and team assignments. -

Interactive Applicant Portal

Invite applicants into the digital experience with a portal to request,

receive, and review necessary documents.

We Know SBA

Our Latest Insights

Financial Inclusion: A Guide for SMB Lenders

Read this article and discover why financial inclusion matters and how lending technology can help SMB lenders support the underbanked an…

Lender Education: Why the Applicant Experience Matters

Your borrowers want a reliable, streamlined applicant experience. Learn why you shoul…

4 Industry Changes to Look for in the Coming Years

The past two years have been a whirlwind for the lending industry. 2020 gave us overw…

Your Frequently Asked Questions

-

SPARK natively integrates with more than 15 different providers, including DocuSign to MeridianLink — and we’re adding more all the time. You can also create custom integrations with your favorite systems using our open API.

-

Yes! Scan business tax returns, income statements, and balance sheets and automatically spread financials based on them to eliminate unnecessary manual data input and create new documents. You can also tailor spreads to your industry with our financial analysis templates.

-

We know credit teams are very particular when it comes to the formats of their credit presentations. That’s why we built a flexible and scalable feature that enables teams to start with a standard credit presentation format (by product) and add to it conditionally or on the fly. You can even embed the statement spreading features directly in the credit presentation to eliminate constant updating of credit memos with changing dynamics of a transaction.

-

It sure does. SPARK natively supports SBA eligibility and uses a lender-configured policy section to enforce conventional lending eligibility. We calculate required information still needed based on the use of proceeds. For example, if a business acquisition is flagged in the use of proceeds, SPARK will automatically trigger the internal operations team to seek a third-party business valuation. And because it’s built into the technology, teams can focus on getting more details down without spending time on mundane tasks.

-

SPARK implements, onboards, and trains in just four weeks for SBA products. For conventional lending, the implementation period is typically six weeks to account for variations in conventional lending processes.

-

SPARK onboards up to six customers per month, so you can typically get started the month you execute your SPARK contract. However, we do not reserve time on our onboarding calendar for customers that do not have signed contracts.

Experience SPARK for Yourself

It’s time to join the digital lending era. See what SPARK can do for your

bank with a tour of the platform, a one-on-one conversation about

your needs, and answers to your biggest questions.