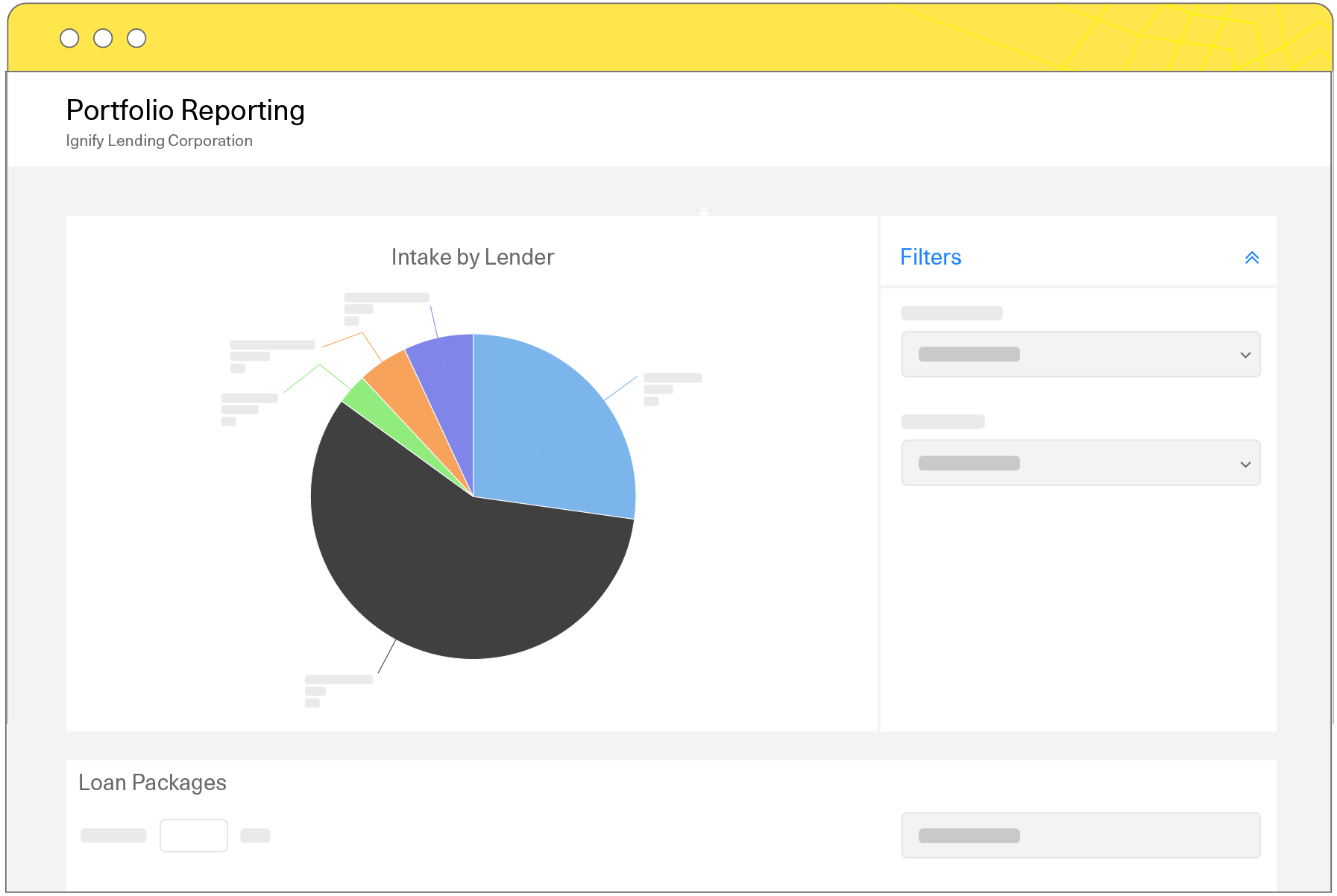

Effortlessly Manage Multiple Lenders at Once

Multi-Lender Capabilities

White Label Solution

Generate More SBA Loans

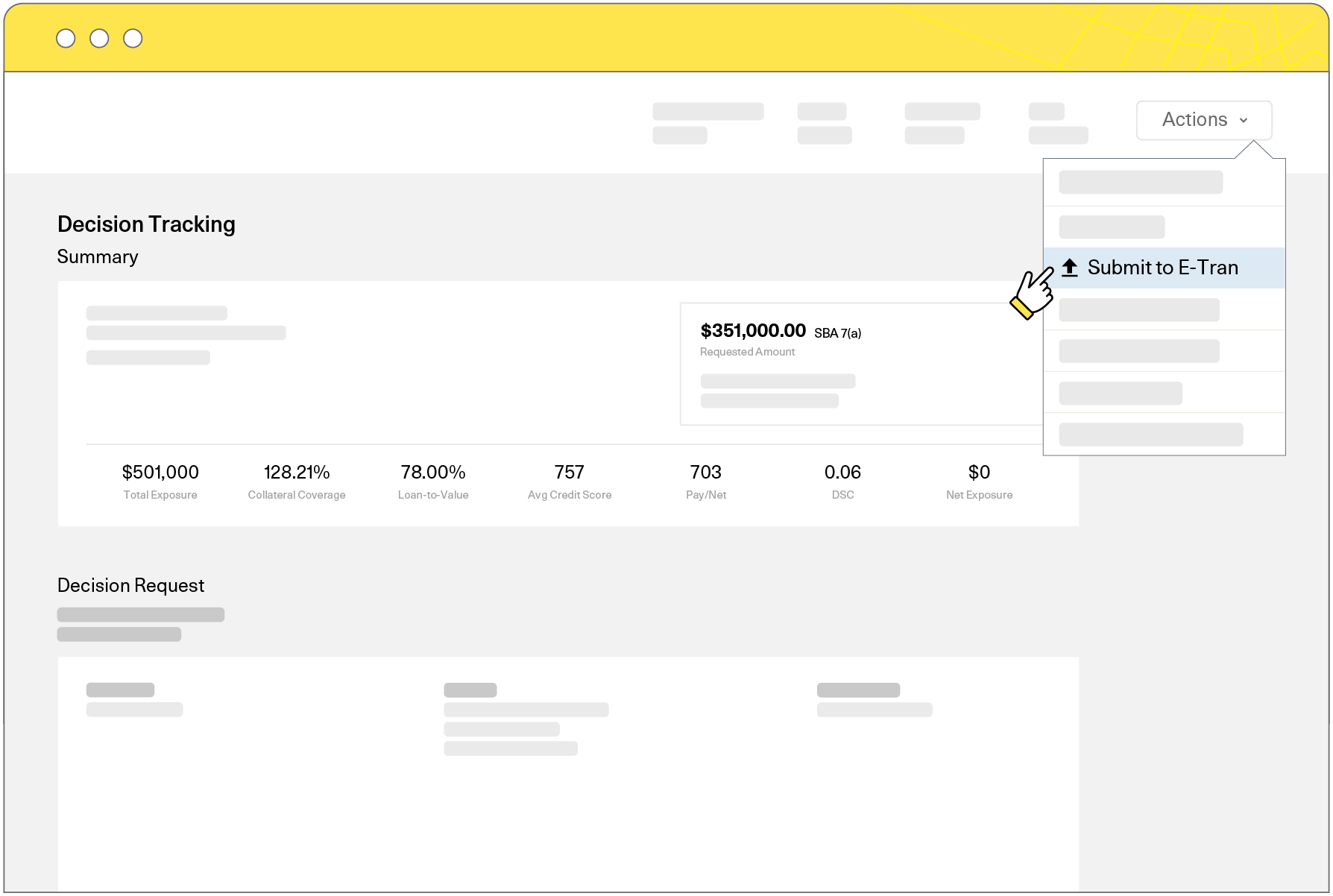

Direct-to-E-Tran Submission

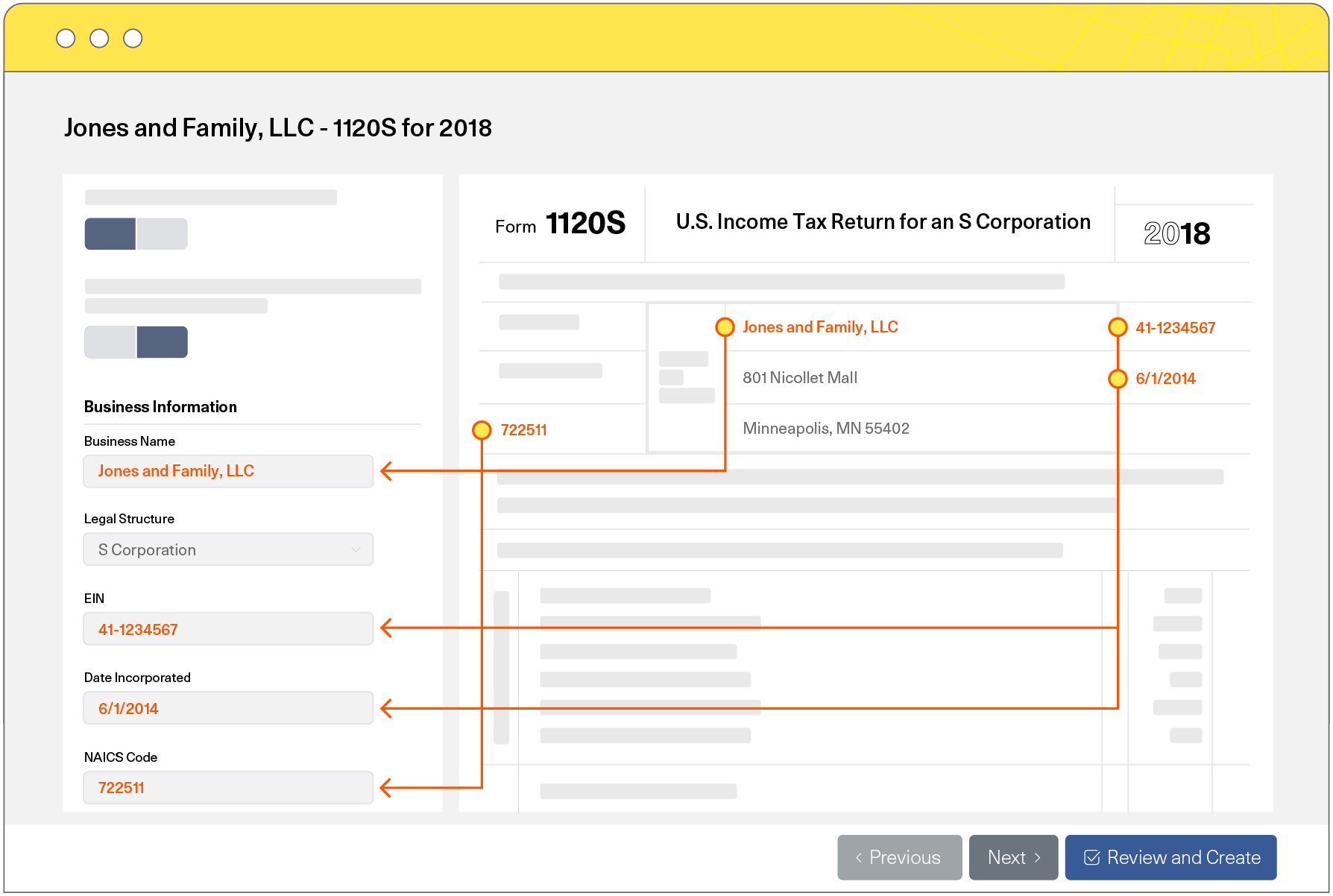

Automated Form Creation

Maximize Lending Efficiency

API-Enabled

a single system.

Document Generation

What LSPs Love About SPARK

-

E-Tran Integration

Auto-generate all your SBA forms and documents, and seamlessly send through our E-Tran integration. -

Partner Portal

Keep partners engaged and informed with a portal to request, receive, and review necessary documents. -

Integrated Eligibility

Track SBA eligibility in real time with tools that automatically update as requirements are met. -

Multi-Lender Support

Easily manage multiple lenders, and invite each into the platform to review information in a snap.

We Know SBA

Our Latest Insights

Financial Inclusion: A Guide for SMB Lenders

Read this article and discover why financial inclusion matters and how lending technology can help SMB lenders support the underbanked an…

Lender Education: Why the Applicant Experience Matters

Your borrowers want a reliable, streamlined applicant experience. Learn why you shoul…

4 Industry Changes to Look for in the Coming Years

The past two years have been a whirlwind for the lending industry. 2020 gave us overw…

Your Frequently Asked Questions

-

Yes! You control how much your lenders can access in SPARK.

-

For sure. You decide which products to support based on different lenders’ needs.

-

Absolutely. Generate forms, automate packaging, and send directly to E-Tran for multiple lenders in one interface.

-

You bet. No more switching between systems or manually generating documents. Eliminate data reentry and customize documents automatically.

See SPARK for Yourself

Let go of disjointed systems and inefficient processes. See how SPARK helps you support multiple lenders with a tour of the platform, a one-on-one conversation about your needs, and answers to your biggest questions.